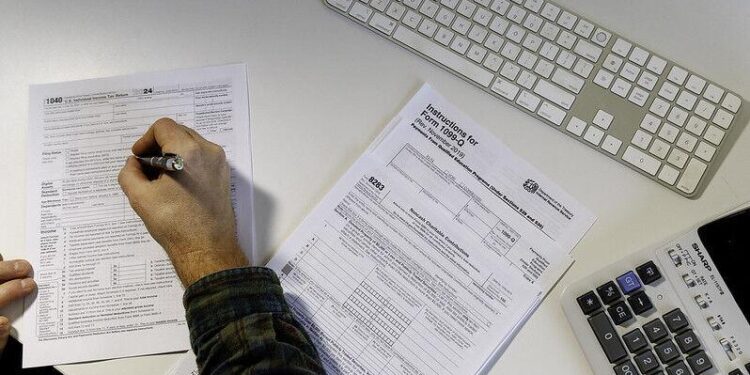

STILLWATER — As 2024 draws to a close, taxpayers still have time to take advantage of valuable tax credits and deductions.

Energy-efficient home improvements, charitable donations, retirement accounts, dependent care and educational expenses are some options that can help ensure a more favorable financial outcome when filing taxes in the spring.

Mengya Wang, Oklahoma State University Extension personal finance specialist, said taxpayers should check the Internal Revenue Service website’s credits and deductions page for information about qualifications. Also, check with product manufacturers to see if credits are available.

“Tax laws can be intimidating and difficult to understand. Fortunately, consumers don’t have to understand all of the tax laws, only what applies to their situation,” Wang said. “Also, taxpayers need to determine if they should take the standard deduction or if they qualify to itemize their return. The standard deduction is a specific dollar amount that reduces the amount of taxable income. If the allowable itemized deductions total is more than the standard deduction, taxpayers are eligible to itemize for greater benefit.”

The IRS website provides information to help taxpayers determine which option is in the taxpayer’s best interest.

For those paying for higher education, The American Opportunity Tax Credit is a benefit that helps reduce tax liability.

“Anyone paying for college expenses knows it can take a toll on the budget. This is a credit for qualified education expenses paid for an eligible student for the first four years of higher education,” Wang said. “The maximum annual credit is $2,500 per eligible student for a maximum of four years.”

If possible, max out any retirement accounts to help build financial security for the future. Taxpayers can donate to an Individual Retirement Account until April 15, 2025, and claim the credit for their 2024 taxes. For those with a 401K or a 403b, contributions must be made by the end of 2024. In addition, contributions may be made to a health savings account.

“If you have younger children, add to or start an Oklahoma 529 college savings plan,” she said. “Individual taxpayers may deduct up to $10,000 in Oklahoma 529 contributions from their adjusted gross income, and taxpayers filing jointly may deduct up to $20,000. As long as the funds are used for qualified educational expenses, the earnings are free from federal and state taxes.”

Tax credits or deductions are available to taxpayers who are taking care of an aging parent or a disabled family member. Also, collect receipts for expenses incurred for dependent care.

Donations to charitable and nonprofit organizations are tax-deductible. Wang cautions taxpayers to confirm the organization is recognized as a qualified recipient by the IRS. Be sure to request a receipt for each charitable donation made by Dec. 31.

“If the standard deduction is higher than the total of a taxpayer’s itemized deductions, including charitable donations, it won’t make a difference how much is donated because the taxpayer will not benefit from itemizing their deductions and will instead take the standard deduction,” Wang said.

Although there is no tax benefit to the gifter, taxpayers may gift up to $18,000 to a child or grandchild. However, the recipient is not liable to pay taxes on the gifted funds.

Tax season is right around the corner, and Wang recommends taxpayers start now by gathering tax-related documents needed for spring filing. Allowing plenty of lead time will help taxpayers be more organized and less likely to miss out on deductions while not falling victim to a tax scam.

Want to reach a local audience and grow your business?

Our website is the perfect platform to connect with engaged readers in your local area.

Whether you're looking for banner ads, sponsored content, or custom promotions, we can tailor a package to meet your needs.

Contact us today to learn more about advertising opportunities!

CONTACT US NOW